Excellency, Mr. B.B. Hamman

His Excellency, Mr. B.B. Hamman, is the Ambassador Extraordinary and Plenipotentiary of the Federal Republic of Nigeria to the Kingdoms of Sweden, Denmark, Norway, and the Republic of Finland.

The Ambassador who is resident in Stockholm arrived in Sweden on 23rd June 2021 and presented his Letter of Credence to the King of Sweden on 1st July 2021, in accordance with the current Special arrangement.

Ambassador Hamman has been a career diplomat in the Nigerian Foreign Service for the last 28 years. Until his appointment as the Ambassador to the Nordics, he was the Acting Head of Mission and Chargé D’Affaires in the Embassy / Permanent Mission of Nigeria in Vienna, Austria. He had also served in various capacities, in several Nigerian diplomatic posts abroad, including Embassy of Nigeria, Budapest, Hungary; Embassy of Nigeria, Luanda, Angola; High Commission of Nigeria, Accra, Ghana; Embassy of Nigeria, Rabat, Morocco, and the Permanent Mission of Nigeria to the United Nations in Geneva, Switzerland.

While at Headquarters of the Ministry of Foreign Affairs in Abuja, Ambassador Hamman had worked under various bilateral and multilateral Departments in different capacities, including as Deputy Director Office of the Minister of Foreign Affairs, Africa Sub-regional Organisation Division, and as Director, Office of the Minister of State for Foreign Affairs.

Ambassador Hamman is married and has four Children

Nigeria offers a wide variety of tourist attractions such as extended and roomy rivers, beaches ideal for swimming as well as other water sports.

News and Events

His Excellency Meets with International IDEA Secretary-General

His Excellency, Ambassador B.B. Hamman, paid a visit to the headquarters of the intergovernmental agency International Institute for Democracy and Electoral Assistance (international-IDEA) in Stockholm in August 2023, where he met with Secretary-General Dr. Kelvin Casas-Zamorra.

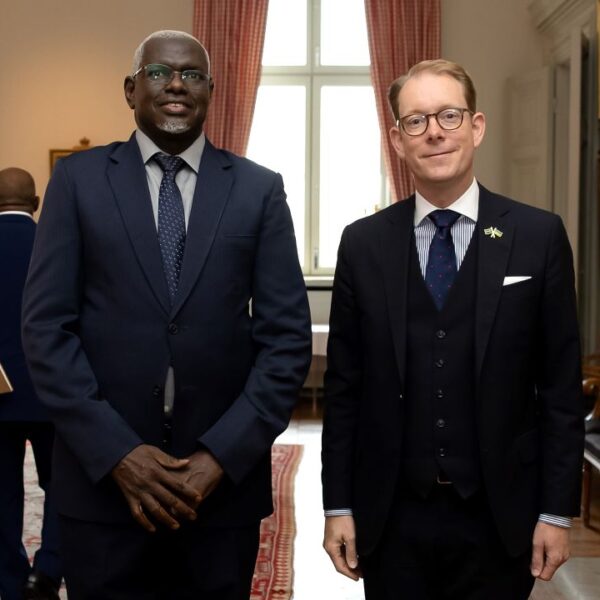

His Excellency Ambassador BB Hamman and the distinguished Minister of Foreign Affairs of Sweden, His Excellency Tobias Billstrom

In an esteemed gathering on August 4th, 2023, His Excellency Ambassador BB Hamman and the distinguished Minister of Foreign Affairs of Sweden, His Excellency Tobias Billstrom, came together to address OIC Ambassadors during a briefing thoughtfully arranged by the Ministry...

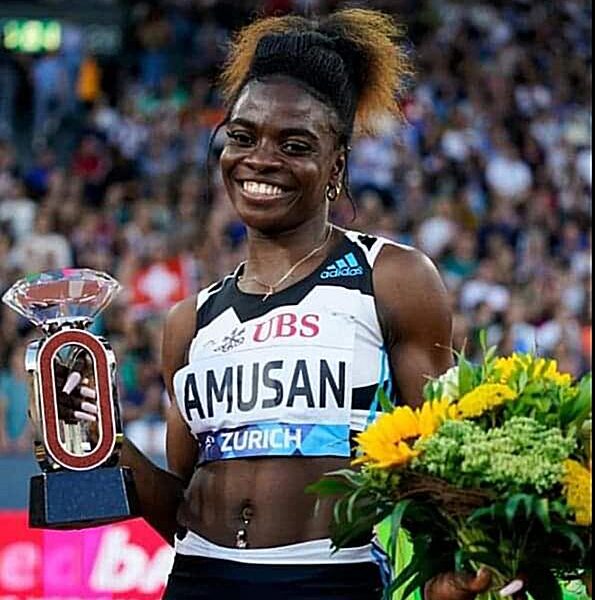

Triumph at the ‘Bauhaus-Galan’: Nigerian Athletes Shine in Stockholm Diamond League

The ‘Bauhaus-Galan’ Wanda Diamond League event took place on Sunday, July 2nd, 2023, at Stockholm Stadion in Sweden. The Diamond League is an annual series of prestigious track and field athletic competitions that consists of fourteen of the best invitational…